Does January feel like a buyer’s market, a balanced market, or something in between, and what should I do differently because of it?

The headline in plain language

January looked a lot like the last couple of winters for sales pace. The difference this year is inventory.

339 properties sold across the VREB region in January.

2,624 active listings were on the market at month-end.

When you combine fewer sales with more listings, the market doesn’t “crash”. It usually does something far more boring and far more useful:

It gives buyers more selection and gives sellers more predictable outcomes.

The Victoria Real Estate Board spoke of January as on the threshold between balanced and a buyer’s market, with the important reminder that Greater Victoria is really a collection of micro-markets. Some areas already feel balanced, others lean more buyer-ish.

Sales cooled, inventory rose

Compared to January of last year, sales were down, and that showed up most in condos and single family homes.

If you’ve been house-hunting lately, this probably feels familiar. Buyers are still out there, but the urgency has been lower for a while now. What’s different this year is the tone. It feels like we’re moving toward a more steady market, where people can take a breath, run the numbers, and make decisions with a bit more confidence instead of guessing what next week will bring.

On the inventory side, we saw more listings available than a year ago and also a bump from December. That matters because inventory is the closest thing we have to oxygen in a market. When buyers have real choice, the market stops behaving erratically. Pricing gets tested more honestly, and outcomes become more measured and predictable.

What happened to prices in the Victoria Core

I lean on the MLS Home Price Index for market commentary because it’s less jumpy than averages and medians.

In the Victoria Core, January benchmarks were $1,265,500 (single family), $537,800 (condo), and $833,100 (townhome). Compared to December and a year ago, detached ticked up month-over-month but is still down year-over-year, while condos are down on both comparisons..

That is not a contradiction. It’s a market trying to find a rhythm. Detached can firm up a bit month-to-month if the right homes sell. Condos can soften if buyers get more choice, or if monthly carrying costs start to matter more again.

A quick way to see why January felt calmer

There are two simple questions that explain a lot of what buyers and sellers are feeling right now:

How many new listings showed up this month?

How many of those listings actually sold?

When you look at those side by side, you can usually tell whether the market is tightening up or loosening.

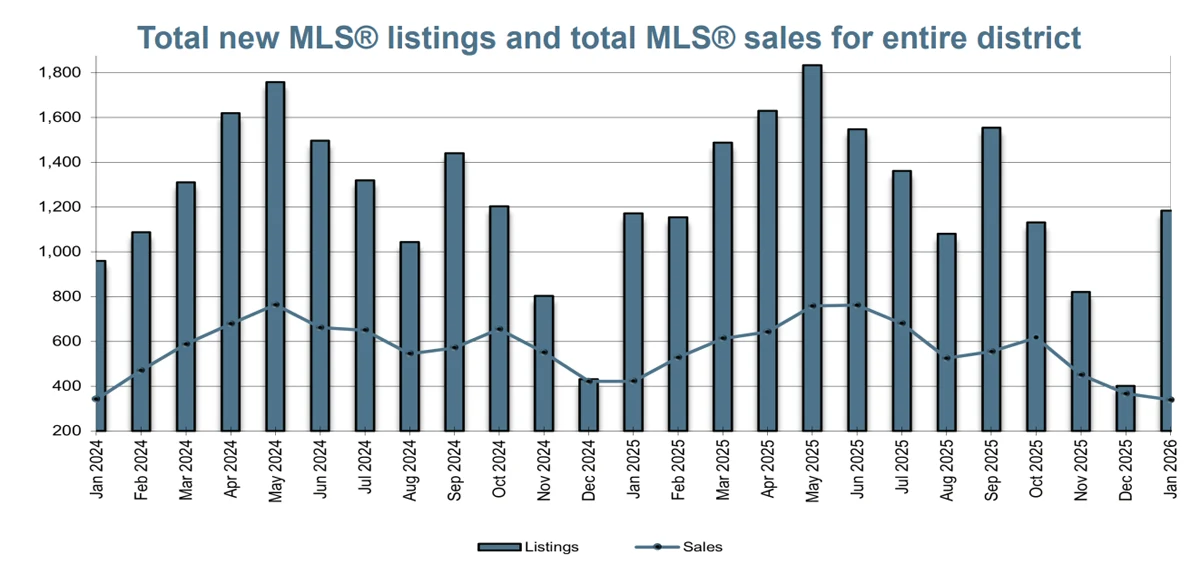

New listings vs. sales (Entire VREB District): New listing supply has been outpacing the sales count, which helps explain why buyers are feeling more choice and a calmer pace.

Source: Victoria Real Estate Board, January 2026 Statistics Package (released Feb 1, 2026).

That first chart is the “flow” view. New listings are the fresh supply coming in. Sales are demand actually being expressed. In January, we saw a decent amount of new inventory compared to the sales pace. That combination is what creates breathing room.

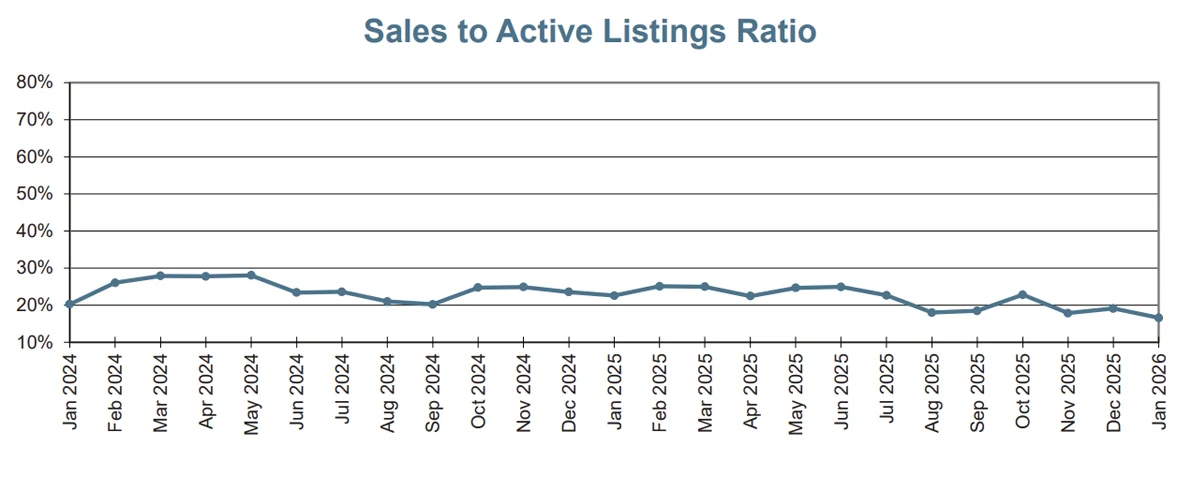

The second chart turns that relationship into a single, easy measure: the sales-to-active listings ratio. Think of it as a quick read on market pressure.

Sales-to-active listings ratio: A simple “market pressure” gauge. Lower ratios usually mean buyers have more leverage; higher ratios usually mean sellers do.

Source: Victoria Real Estate Board, January 2026 Statistics Package (released Feb 1, 2026). Interpretation thresholds referenced from BCREA methodology as noted in the VREB package.

BCREA’s interpretation (which VREB references in the stats package) uses these guideposts for Greater Victoria:

Below 17%: tends to lean buyer, with more downward pressure on prices

17% to 28%: generally balanced, with less pressure either way

Above 28%: tends to lean seller, with more upward pressure on prices

Right now we’re sitting close to that balanced-to-buyer edge. That lines up with what I’m seeing on the ground. Buyers have more choice, there’s less urgency, and negotiations feel more measured. Not slow, just more steady.

A quick story from the ground

Over the past year, a lot of buyers have felt stuck in that awkward middle zone. They liked homes. They could afford them. But they kept waiting for the world to calm down first. Rates, headlines, the general sense that something might break. So they toured, asked good questions, and then… paused. Not because they were unserious. More because they were trying to buy certainty, and certainty hasn’t really been for sale.

What’s felt different in late December and January is that some of that hesitation seems to be wearing off.

I’m seeing it first-hand on a new construction project I’m selling. For months we had steady traffic and good feedback. People genuinely liked the homes. The conversations were warm. A bunch of them asked to be kept in the loop if “anything changed” or if we saw serious buyer activity. The interest was real, but the offers weren’t showing up. It was classic tire-kicking with a rational explanation behind it.

Then, a switch seemed to flip. Several units sold in a relatively short window. Not in a frenzy, and not with that old “offer night panic” energy. More like: okay, we’ve waited long enough, we’re ready to get on with living. Buyers still did their homework, but they stopped waiting for perfect conditions and started making decisions inside the conditions we actually have.

Maybe it’s an anomaly. Maybe it’s the first hint of a broader shift as 2026 gets moving. Either way, this is where the sales-to-active listings ratio is worth watching. If sales start keeping up with inventory more consistently, that’s usually the earliest sign that the “fence-sitting” phase is fading and the market is finding a more steady rhythm.

What this means if you’re buying

If you’re buying in early 2026, this market can be a gift if you use it properly.

You gain:

More selection

More time for due diligence

Room to negotiate on price, dates, and terms (depending on the micro-market)

You give up:

Practical moves I’d focus on:

Shop micro-markets, not headlines. A condo in one pocket of the core can behave very differently than a condo two neighbourhoods over - or the Toronto trend you’re seeing on CBC.

Move fast only when the home is truly right. Calm does not mean slow. It means you can be decisive for good reasons instead of panic.

If you’re sorting out process, timing, financing, and due diligence, I laid it out in plain English in my Buyers Guide, with specific resources for first time buyers, downsizers, and https://isellvictoria.ca/move-up-growing-families.html

What this means if you’re selling

If you’re selling, the bar is simply higher than it was in the early 2020s.

You gain:

More predictable buyer behaviour

Fewer chaotic offer nights (in most cases)

A clearer sense of what “the market” will reward

You give up:

Practical moves I’d focus on:

Price for today, not last year. Especially in segments where inventory has built up.

Presentation matters more in a choice-rich market. Clean, bright, and well-maintained is not “nice to have”. It’s leverage.

Plan for negotiation. Not because you’re weak, but because buyers have alternatives.

This isn’t right for everyone, but it’s especially important for sellers who are “testing the market.” When inventory is higher, testing can turn into sitting.

If you’re thinking about selling, I put together a straightforward Sellers Guide so you can plan without guessing.

The bigger backdrop: rates, confidence, and outside noise

VREB mentioned the mix of interest rates, global trade tensions, and consumer confidence as the kinds of external factors that can steer the year.

That’s a fair summary of where we are. Rates have been more stable lately, but stability doesn’t automatically create urgency. It creates predictability. Predictability helps people make decisions, but it doesn’t force them to.

Provincial and national outlooks I’ve read recently are broadly in the same neighbourhood: a slow return toward more normal conditions, not a dramatic surge. That usually translates in Victoria to a market that rewards realistic pricing, good homes, and clear strategy.

My take

More selection. Less rushing. More defined outcomes.

That’s healthy. It’s also a market where the gap widens between homes that are positioned well and homes that aren’t. If you’re buying, you can be thoughtful. If you’re selling, you need to be intentional.

If you’re weighing a move this spring, I’m always happy to talk it through. No pressure. Just a straight conversation about options and trade-offs.

About Bil Greene:

Bil Greene is a Victoria realtor since 2006. He helps buyers and sellers across Greater Victoria make clear decisions without hype or pressure.

Sources